Host Resources & Finance

The Best Airbnb Spreadsheet of 2026: Track Your Rental Profits

Running a short-term rental is not passive income; it is a full-fledged hospitality business. From coordinating with cleaning crews and replacing broken coffee makers to navigating local occupancy taxes, the day-to-day operations can quickly overwhelm new hosts. But the biggest trap isn’t operational—it’s financial. Far too many property managers rely solely on the native platform dashboard to measure their success. This is a massive mistake that will heavily impact your bottom line come tax season.

The earnings dashboard provided by the app shows your gross payouts and platform fees, but it is completely blind to the reality of your operating costs. It doesn’t know about your mortgage interest, your utility bills, or the emergency plumber you had to call on a Sunday. To capture the true profitability of your rental, you need an external system. In 2026, many hosts are searching for the **best airbnb spreadsheet** to act as their financial command center, bypassing expensive monthly software subscriptions for a reliable, customizable, and cost-effective method.

SaaS vs Spreadsheet: Why Google Sheets Wins

When you start researching bookkeeping for your property, you will inevitably be bombarded by ads for software like QuickBooks Online, Xero, or specialized property management systems. Are they powerful? Yes. Are they necessary for a host with one to five properties? Absolutely not.

Using the **best airbnb spreadsheet** built in Google Sheets or Microsoft Excel offers three distinct advantages over expensive SaaS subscriptions:

- Zero Monthly Fees: Commercial accounting software can cost upwards of $30 to $80 a month. Over a year, that is nearly $1,000 eaten directly out of your cash flow. A spreadsheet is a one-time setup that lives in your free Google Workspace.

- Ultimate Customization: If you want to calculate your “RevPAR” (Revenue Per Available Room) alongside your monthly cleaning supply costs, the **best airbnb spreadsheet** allows you to build that exact formula. SaaS platforms lock you into their predefined reporting structures.

- Data Ownership: You own the data. You aren’t held hostage by a software company that decides to hike its subscription prices by 20% next year. You can share a secure link instantly with your CPA.

What Makes the Best Tracker?

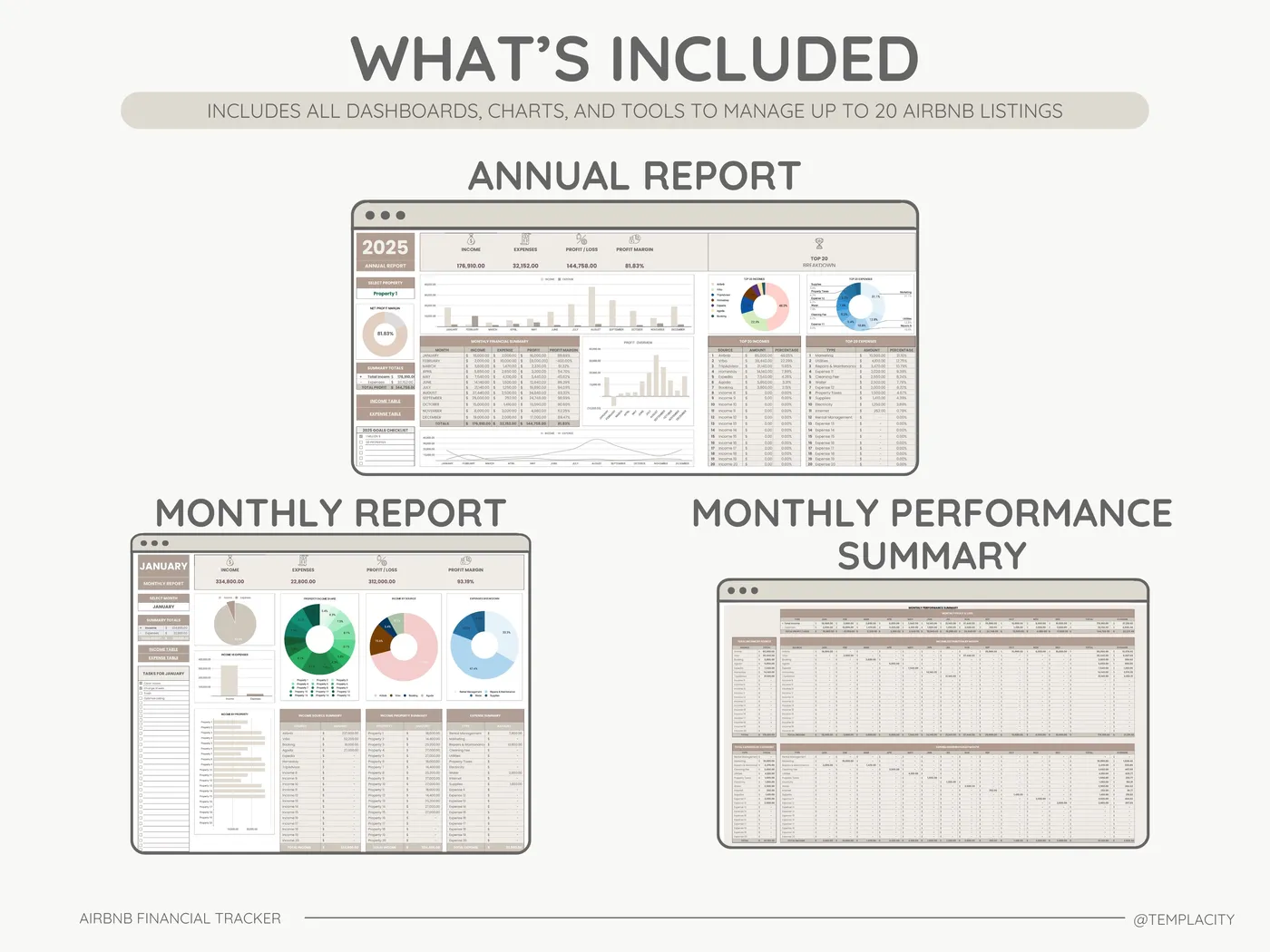

A blank document is useless. To build or buy the **best airbnb spreadsheet**, you need to ensure it has specific features designed for the short-term rental industry. Mis-categorizing items means you might miss out on crucial tax deductions or, worse, trigger an audit. According to guidelines provided by the IRS for Rental Real Estate, your tracker must include:

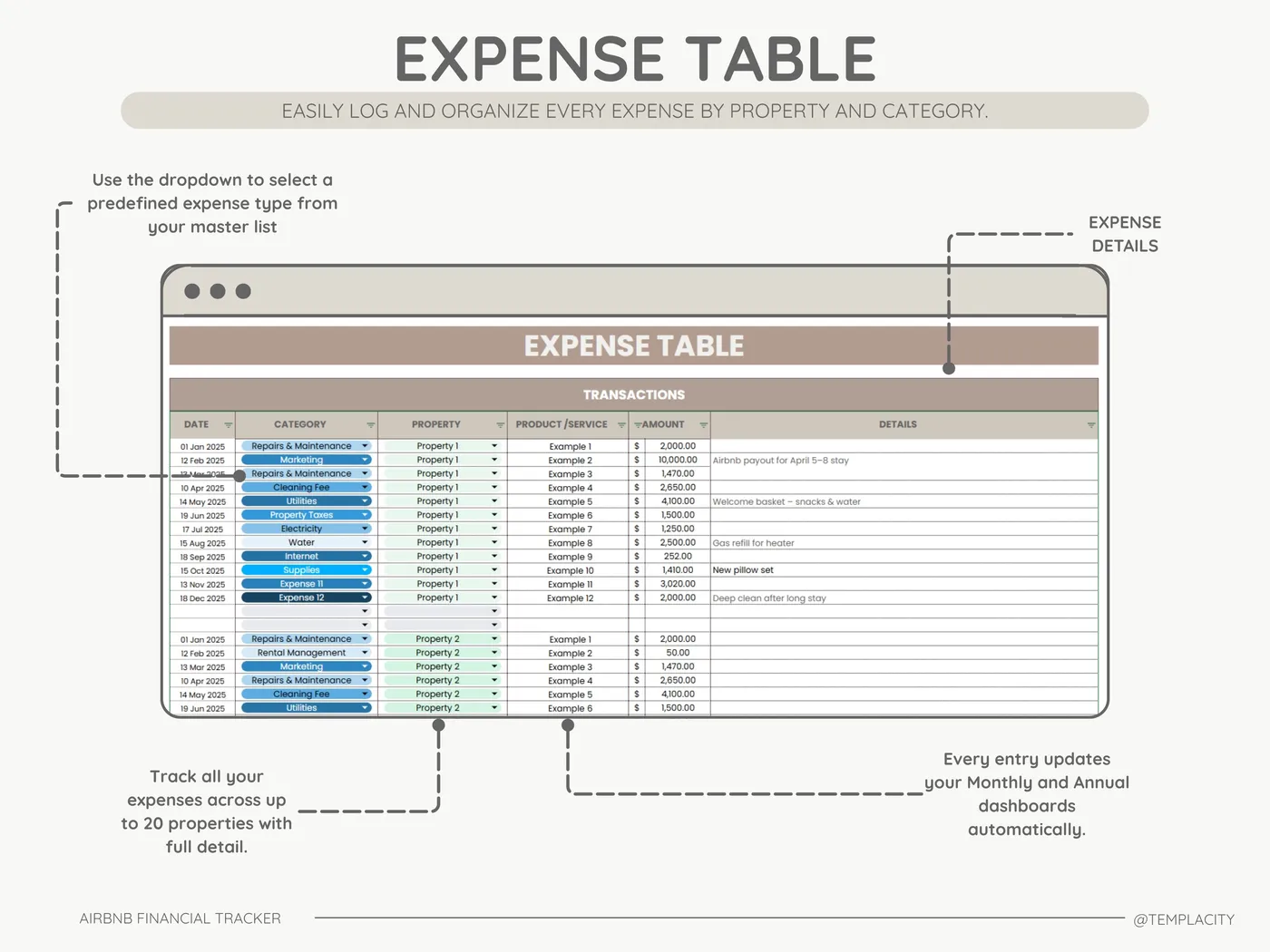

1. Dynamic Dropdown Menus

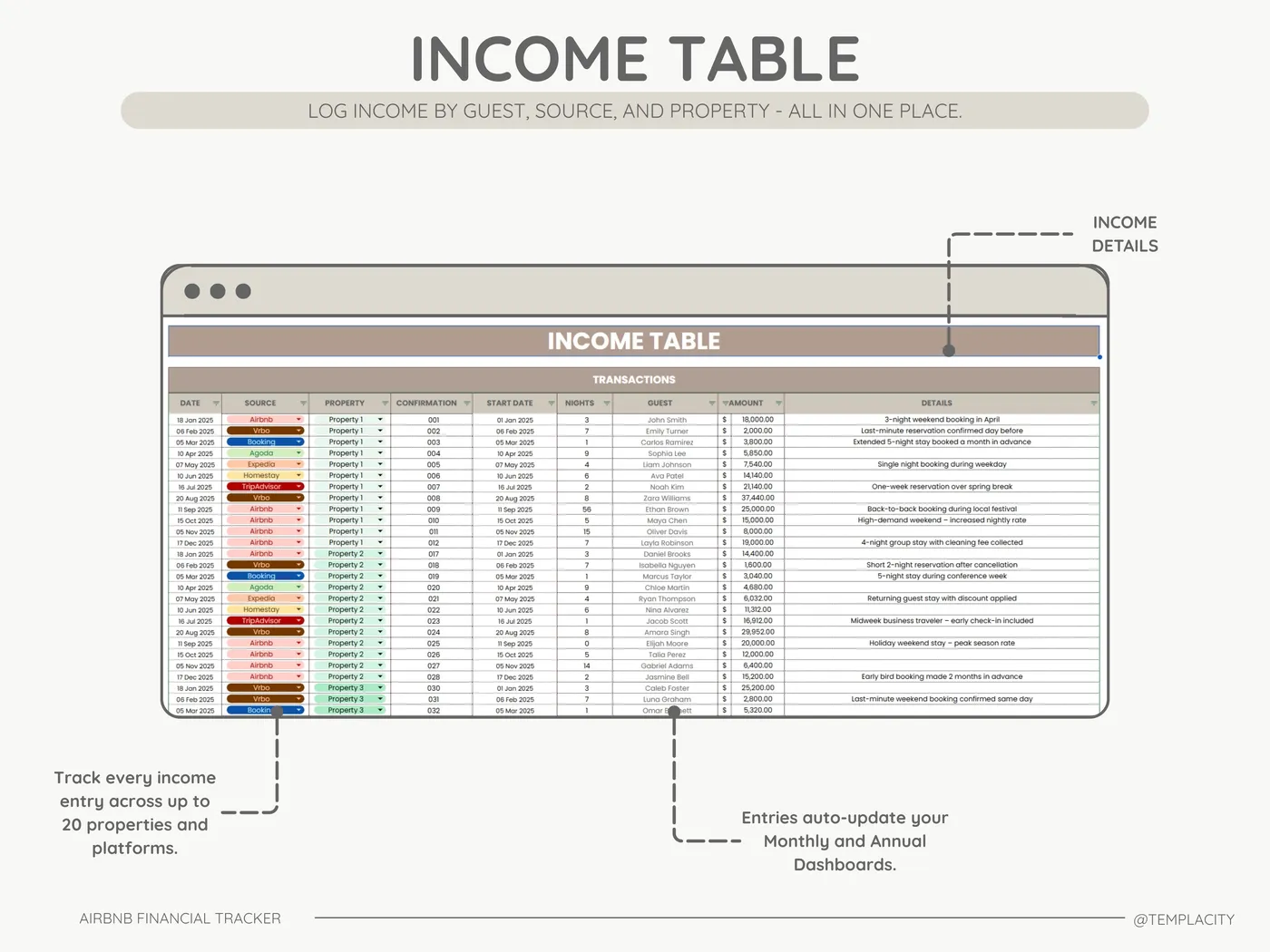

You cannot afford typos in your bookkeeping. If you type “Cleaning” one day and “Cleaners” the next, your summary formulas will break. The **best airbnb spreadsheet** will use strict data validation to keep your categories consistent.

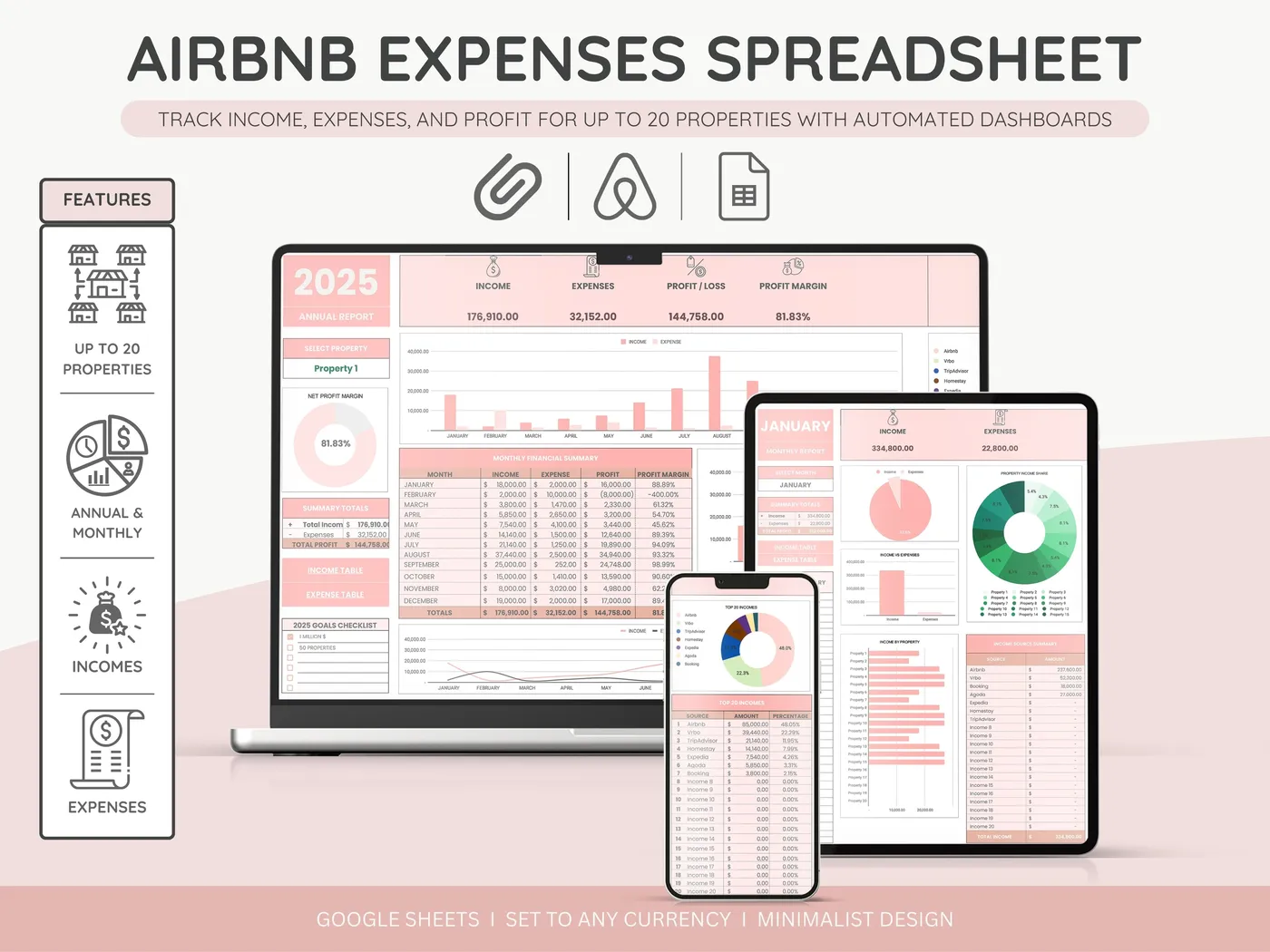

2. Multi-Property Support

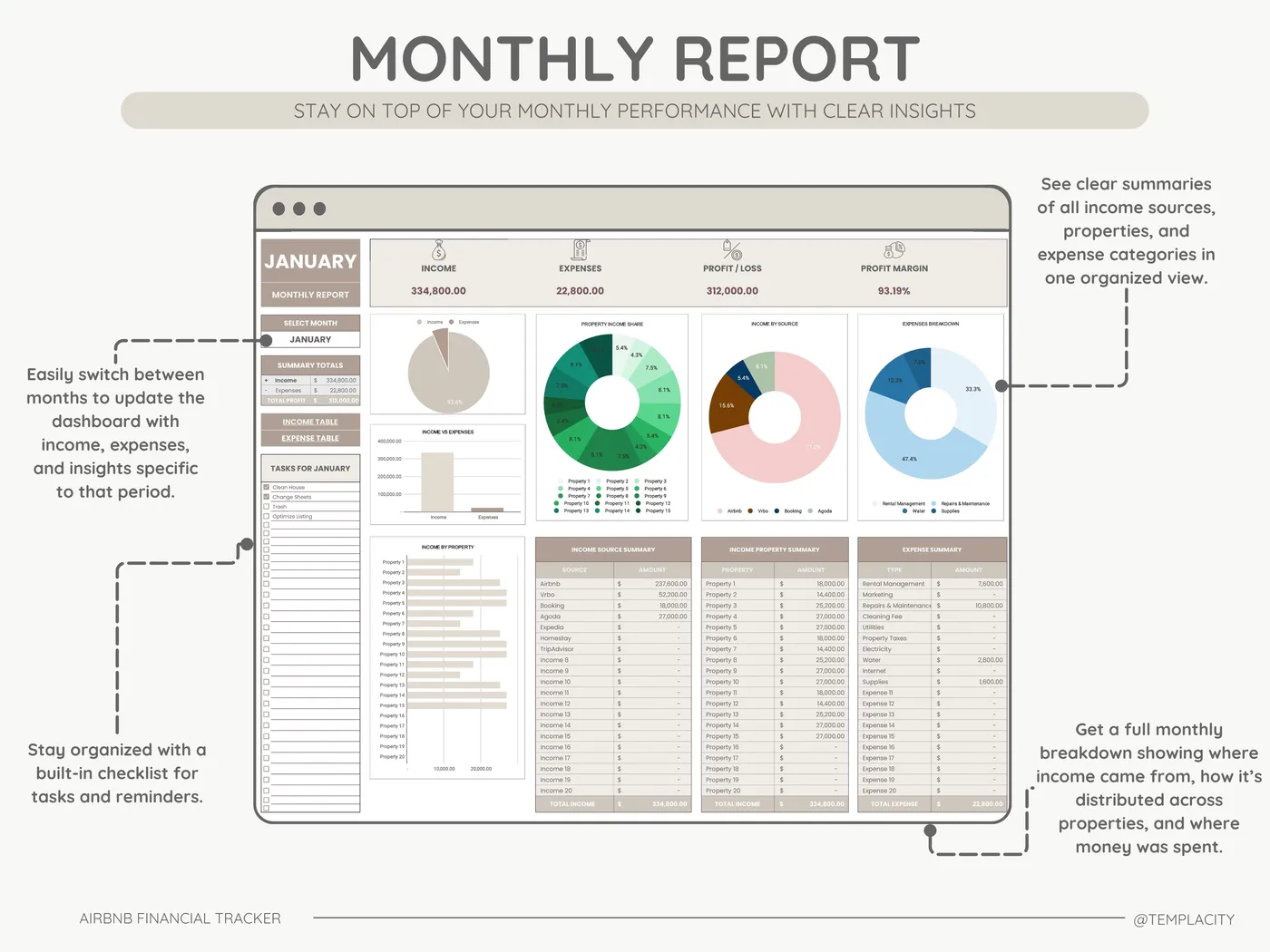

Even if you only have one property now, you might expand. Your tracker needs the ability to filter income and expenses by “Property A” and “Property B” so you can see which listing is actually generating a return on investment.

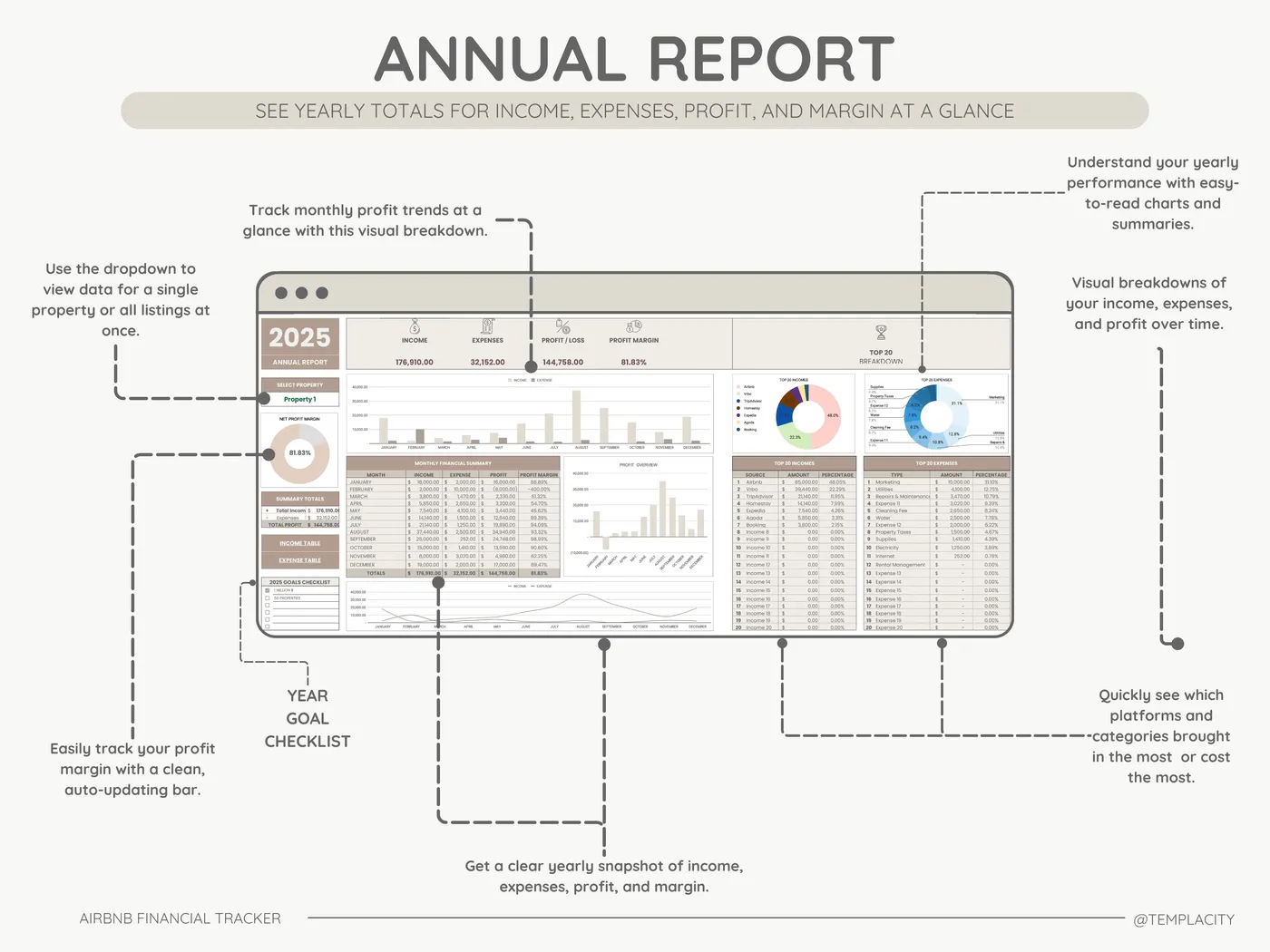

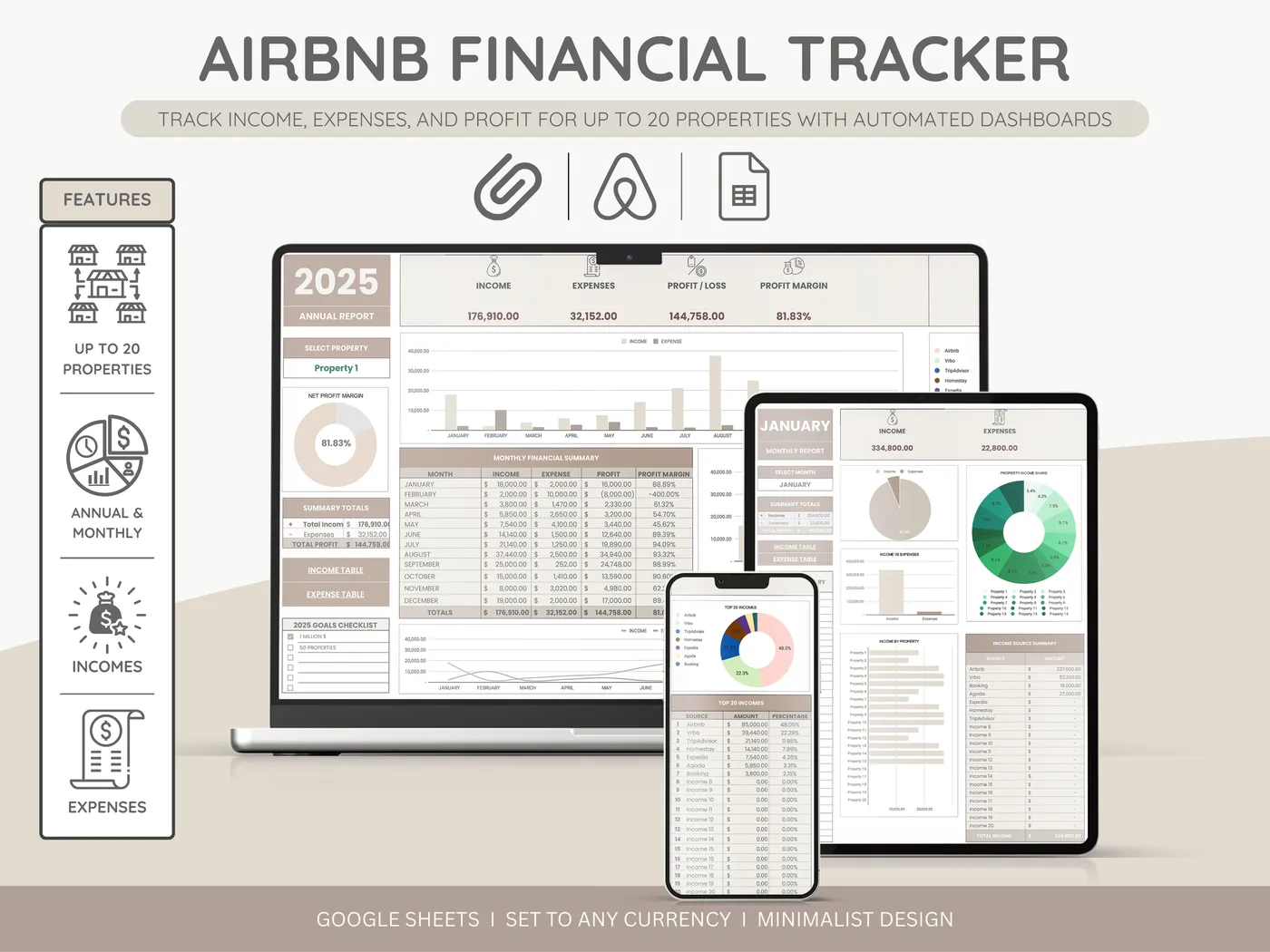

3. Visual Dashboards

Staring at rows of numbers is exhausting. You need a visual representation of your cash flow. Automated pie charts showing expense breakdowns (e.g., Utilities vs Maintenance) are crucial for spotting operational leaks.

The Gross vs Net Revenue Trap

This is where amateur hosts fail. Airbnb deposits your net payout into your bank account. However, for tax purposes, you need to track your gross revenue and record the platform fee as a separate expense line.

For example, if a guest pays $1,000, and Airbnb takes a $30 host fee, your bank deposit is $970. If you only log $970 as your income, your books are legally incorrect. The **best airbnb spreadsheet** accounts for this discrepancy, providing separate columns for Gross Fare, Cleaning Fees Collected, Platform Fees, and Final Payout, ensuring your numbers are legally compliant.

The Danger of “Automated” Bookkeeping

In 2026, many apps promise to “automatically categorize” your bank transactions. You link your bank account, and the AI promises to do your bookkeeping for you. Do not fall for this trap.

The AI does not know if a $300 purchase at Home Depot was for a new microwave (which is a depreciable asset) or for bulk cleaning supplies (which is a current expense). It doesn’t know if a charge from Amazon was for your personal life or for the rental. If you rely blindly on automation, your books will be highly inaccurate.

Using a manual or semi-automated approach with the **best airbnb spreadsheet** forces you to review your numbers. Spending 20 minutes every Sunday logging your receipts keeps you intimately connected to your cash flow. It helps you notice when the electricity bill spikes unseasonably or when you are spending far too much on SaaS tools like AirDNA or digital guidebook apps.

Preparing for Tax Season (Schedule E)

The ultimate goal of bookkeeping is to make tax season completely painless. If you operate your rental as an individual or a single-member LLC, you will likely report this income on IRS Form 1040, Schedule E (Supplemental Income and Loss).

A poorly organized ledger means you will spend 40 hours in April digging through credit card statements and cross-referencing booking calendars. The **best airbnb spreadsheet** is designed with Schedule E in mind. The dropdown columns in your tracker should mirror the exact line items on the tax form. When your CPA asks for your “Advertising” spend or “Repairs” total, you simply pull the sum directly from your dashboard.

For more detailed information on navigating short-term rental taxes and platform reporting, the Airbnb Resource Center offers excellent regional tax guides.

Final Verdict

Why do so many short-term rental hosts fail to scale their business? It is rarely because they don’t get bookings. It is because they bleed cash through untracked expenses, poor pricing strategies, and missing tax deductions.

You don’t need to be an accountant, but you do need a reliable system. Finding the **best airbnb spreadsheet** gives you the perfect middle ground between the chaos of a shoebox full of receipts and the expensive overkill of corporate software. By tracking every dollar, you gain the clarity you need to run your rental like a true, profitable business.

Stop Guessing Your Profits

Don’t spend hours wrestling with complex formulas and broken charts. Download what we believe is the **best airbnb spreadsheet** available—a pre-built Google Sheets template designed specifically for hosts. It includes automated dashboards, dynamic drop-downs, and built-in Schedule E categorization.