Host Resources & Finance

The Ultimate Airbnb Expense Spreadsheet: 2026 Guide for Hosts

Running a short-term rental is not passive income; it is a hospitality business. From coordinating with cleaning crews and replacing broken coffee makers to navigating local occupancy taxes, the day-to-day operations can quickly overwhelm new hosts. But the biggest trap isn’t operational—it’s financial. Far too many property managers rely solely on the native platform dashboard to measure their success. This is a massive mistake that will heavily impact your bottom line come tax season.

The earnings dashboard provided by the app shows your gross payouts and platform fees, but it is completely blind to the reality of your operating costs. It doesn’t know about your mortgage interest, your utility bills, or the emergency plumber you had to call on a Sunday. To capture the true profitability of your rental, you need an external system. In 2026, despite the push for AI accounting software, a well-structured **airbnb expense spreadsheet** remains the most reliable, customizable, and cost-effective method for managing your property’s finances.

SaaS vs Spreadsheet: Why Google Sheets Wins

When you start researching bookkeeping for your property, you will inevitably be bombarded by ads for software like QuickBooks Online, Xero, or specialized property management systems. Are they powerful? Yes. Are they necessary for a host with one to five properties? Absolutely not.

Using a dedicated **airbnb expense spreadsheet** built in Google Sheets or Microsoft Excel offers three distinct advantages over expensive SaaS subscriptions:

- Zero Monthly Fees: Commercial accounting software can cost upwards of $30 to $80 a month. Over a year, that is nearly $1,000 eaten directly out of your cash flow. A spreadsheet is a one-time setup that lives in your free Google Workspace.

- Ultimate Customization: If you want to calculate your “RevPAR” (Revenue Per Available Room) alongside your monthly cleaning supply costs, a spreadsheet allows you to build that exact formula. SaaS platforms lock you into their predefined reporting structures.

- Data Ownership: You own the data. You aren’t held hostage by a software company that decides to hike its subscription prices by 20% next year. You can share a secure link instantly with your CPA.

The Core Deductions You Must Track

A blank document is useless. To build an effective **airbnb expense spreadsheet**, you need to categorize your spending accurately. Mis-categorizing items means you might miss out on crucial tax deductions or, worse, trigger an audit. According to guidelines provided by the IRS for Rental Real Estate, every host needs these buckets:

1. Fixed Property Costs

These are the expenses you pay regardless of whether the calendar is full or empty. Mortgage interest, property taxes, HOA fees, and standard home insurance policies. (Note: Only the interest portion of your mortgage is typically deductible as a business expense, not the principal).

2. Utilities & Subscriptions

Water, gas, electricity, high-speed internet, and streaming subscriptions (Netflix/Hulu provided for guests). You should also include SaaS tools here, such as pricing software like AirDNA or digital guidebook apps.

3. Cleaning & Maintenance

This is often the largest variable expense. Track the fees paid to your cleaning crew, landscaping services, pool maintenance, and one-off repairs. Your **airbnb expense spreadsheet** must clearly separate regular maintenance from major capital improvements (like a new roof), as they are taxed differently.

The Danger of “Automated” Bookkeeping

In 2026, many apps promise to “automatically categorize” your bank transactions. You link your bank account, and the AI promises to do your bookkeeping for you. Do not fall for this trap.

The AI does not know if a $300 purchase at Home Depot was for a new microwave (which is a depreciable asset) or for bulk cleaning supplies (which is a current expense). It doesn’t know if a charge from Amazon was for your personal life or for the rental. If you rely blindly on automation, your books will be highly inaccurate.

Using a manual or semi-automated **airbnb expense spreadsheet** forces you to review your numbers. Spending 20 minutes every Sunday logging your receipts keeps you intimately connected to your cash flow. It helps you notice when the electricity bill spikes unseasonably or when you are spending far too much on premium coffee pods.

How to Set Up Your Tracker

If you are looking to deploy an **airbnb expense spreadsheet** successfully, you need to establish strict financial hygiene. Follow these best practices:

- Separate Your Bank Accounts: Never mix personal and business expenses. Open a dedicated checking account and a specific credit card solely for your rental property.

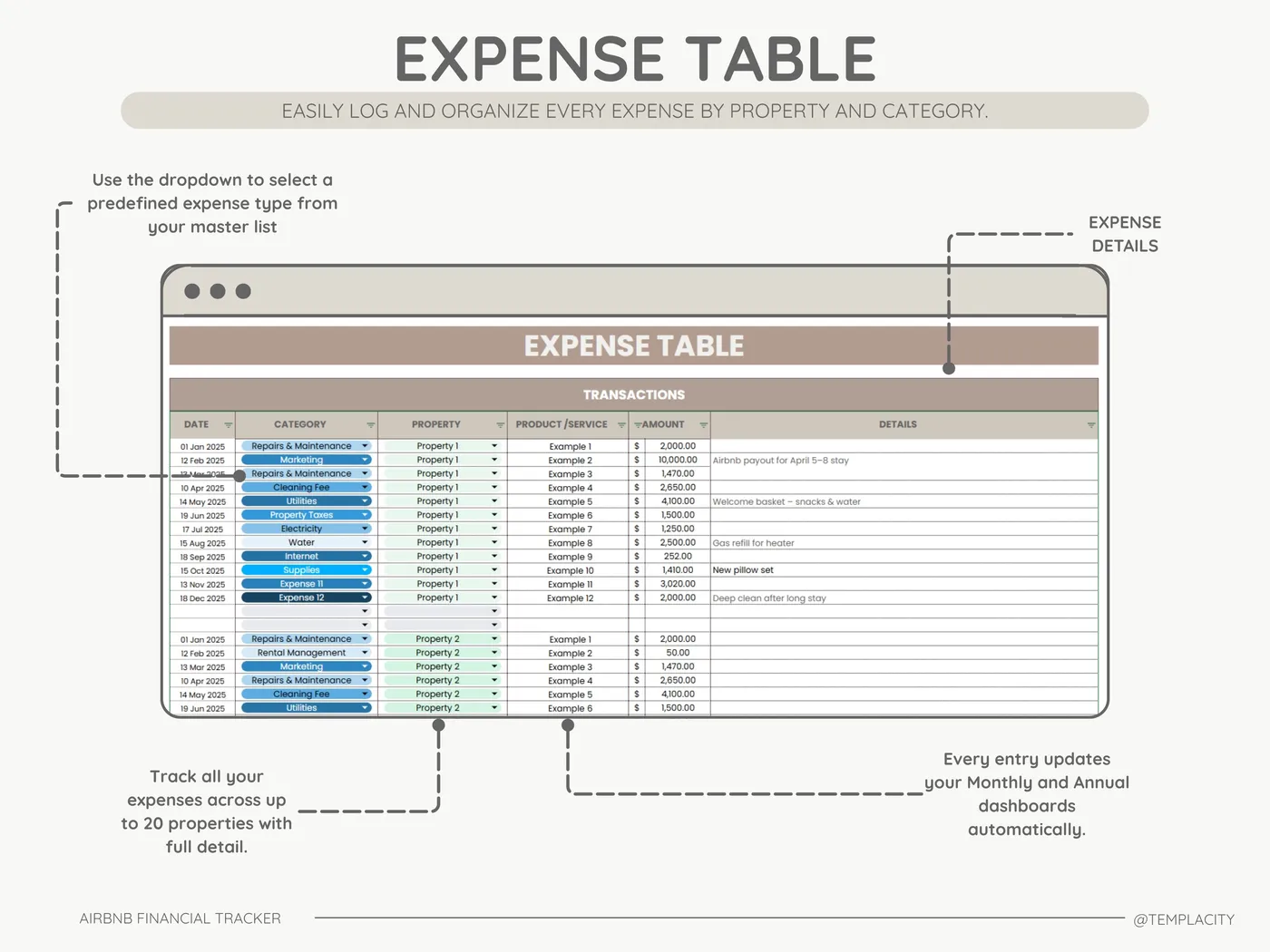

- Use Data Validation: In Google Sheets, use “Dropdown Menus” for your categories. Do not type “Cleaning” one day and “Cleaners” the next. Inconsistent spelling breaks your summary charts and SUMIFS formulas.

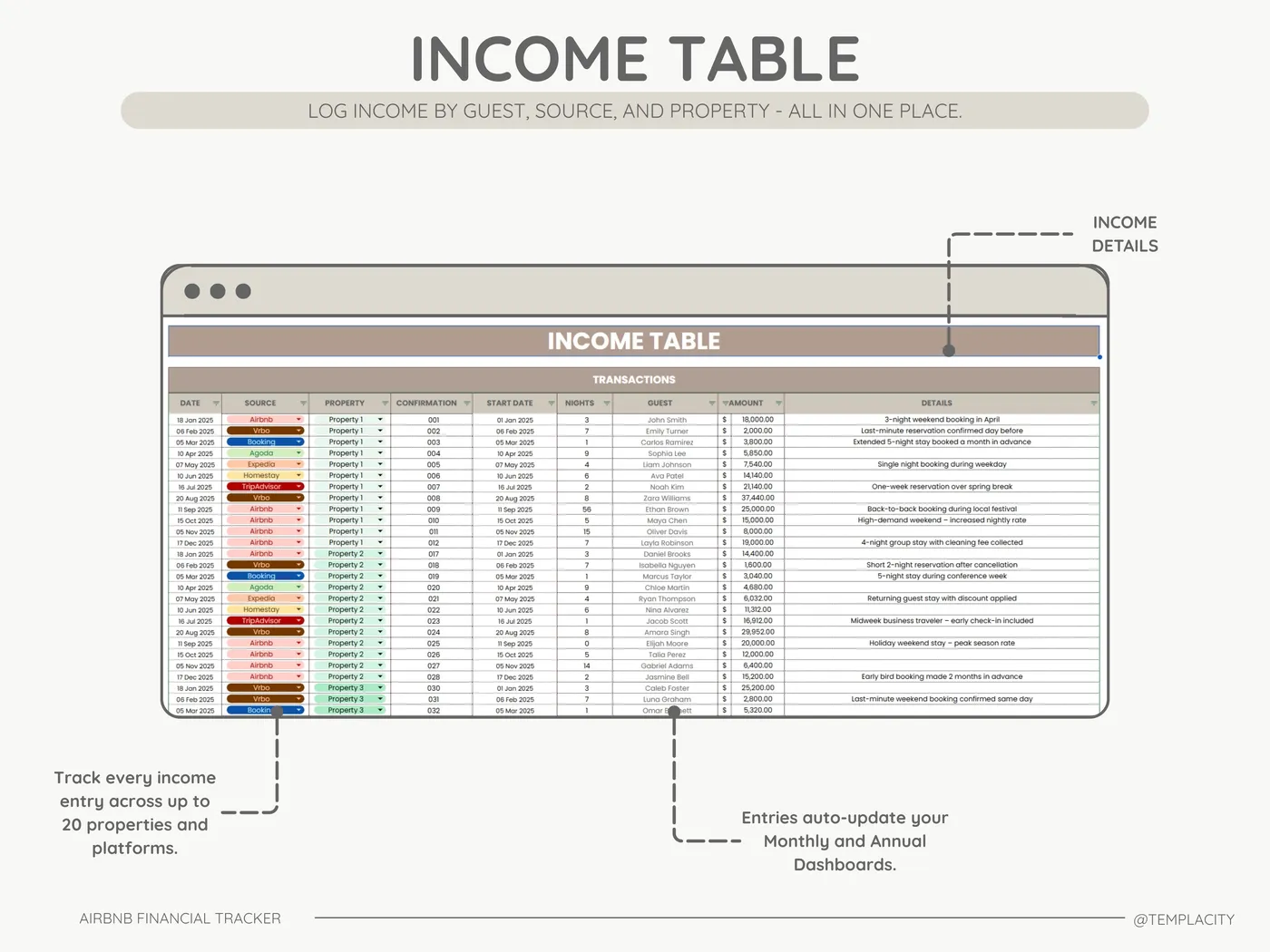

- Log Platform Fees Properly: Airbnb deposits your net payout into your bank account. However, for tax purposes, you need to track your gross revenue and record the platform fee as a separate expense line. Your **airbnb expense spreadsheet** must account for this discrepancy to keep your numbers legally compliant.

Preparing for Tax Season (Schedule E)

The ultimate goal of an **airbnb expense spreadsheet** is to make tax season completely painless. If you operate your rental as an individual or a single-member LLC, you will likely report this income on IRS Form 1040, Schedule E (Supplemental Income and Loss).

A poorly organized ledger means you will spend 40 hours in April digging through credit card statements and cross-referencing booking calendars. A professional **airbnb expense spreadsheet** is designed with Schedule E in mind. The dropdown columns in your tracker should mirror the exact line items on the tax form. When your CPA asks for your “Advertising” spend or “Repairs” total, you simply pull the sum directly from your dashboard.

For more detailed information on navigating short-term rental taxes and platform reporting, the Airbnb Resource Center offers excellent regional tax guides.

Final Verdict

Why do so many short-term rental hosts fail to scale their business? It is rarely because they don’t get bookings. It is because they bleed cash through untracked expenses, poor pricing strategies, and missing tax deductions.

You don’t need to be an accountant, but you do need a reliable system. A dedicated **airbnb expense spreadsheet** is the perfect middle ground between the chaos of a shoebox full of receipts and the expensive overkill of corporate software. By tracking every dollar, you gain the clarity you need to run your rental like a true, profitable business.

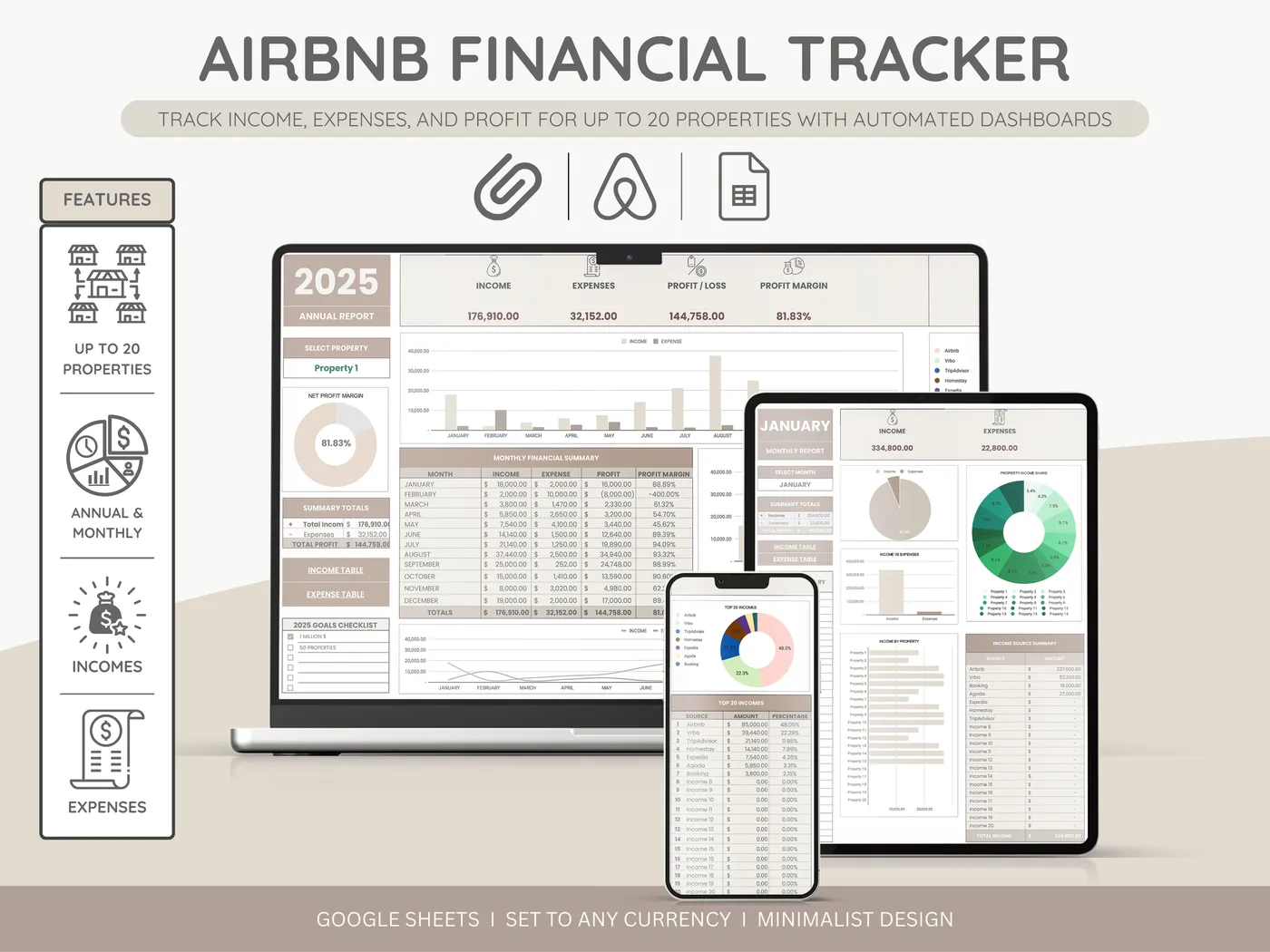

Stop Guessing Your Profits

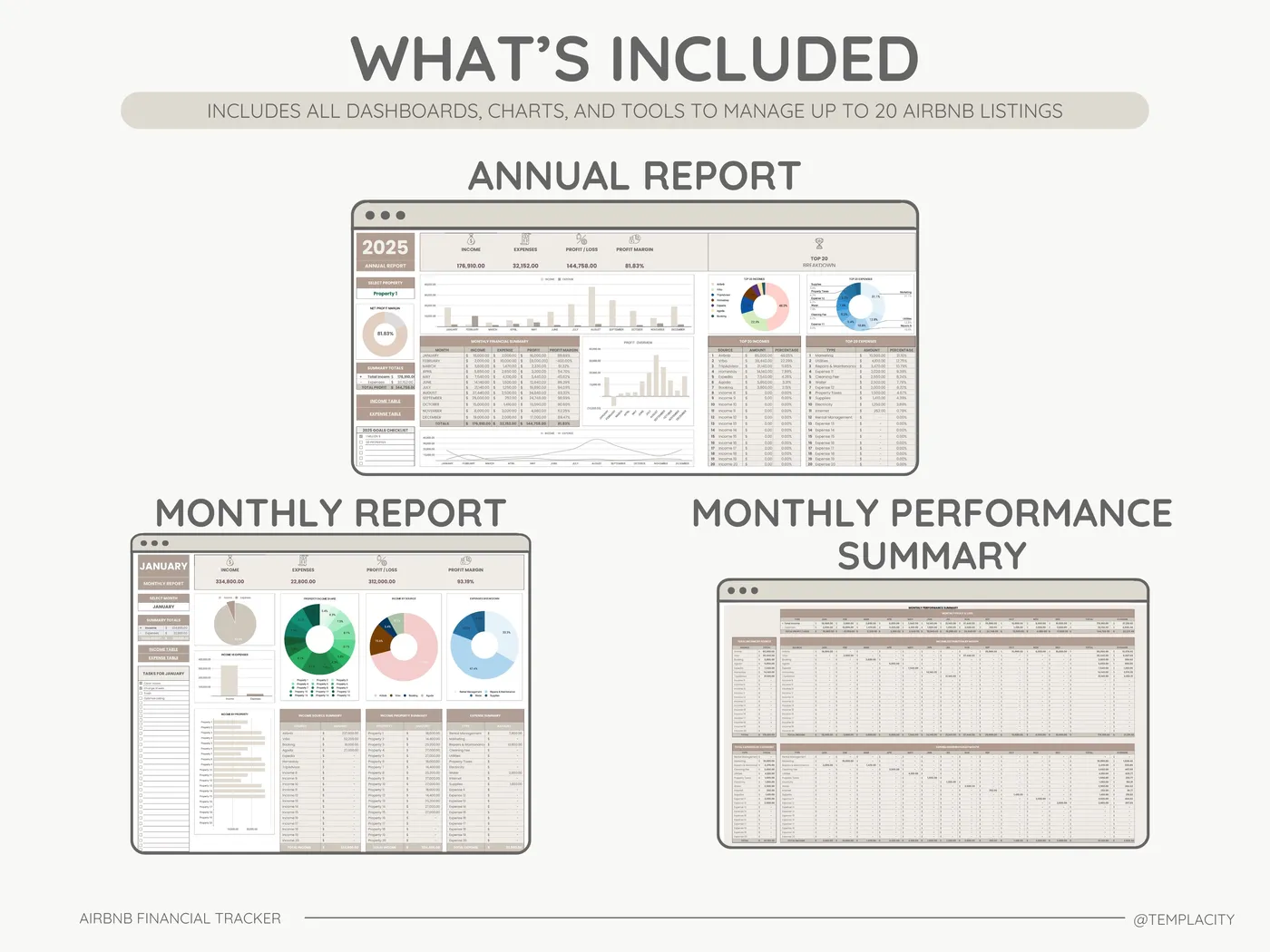

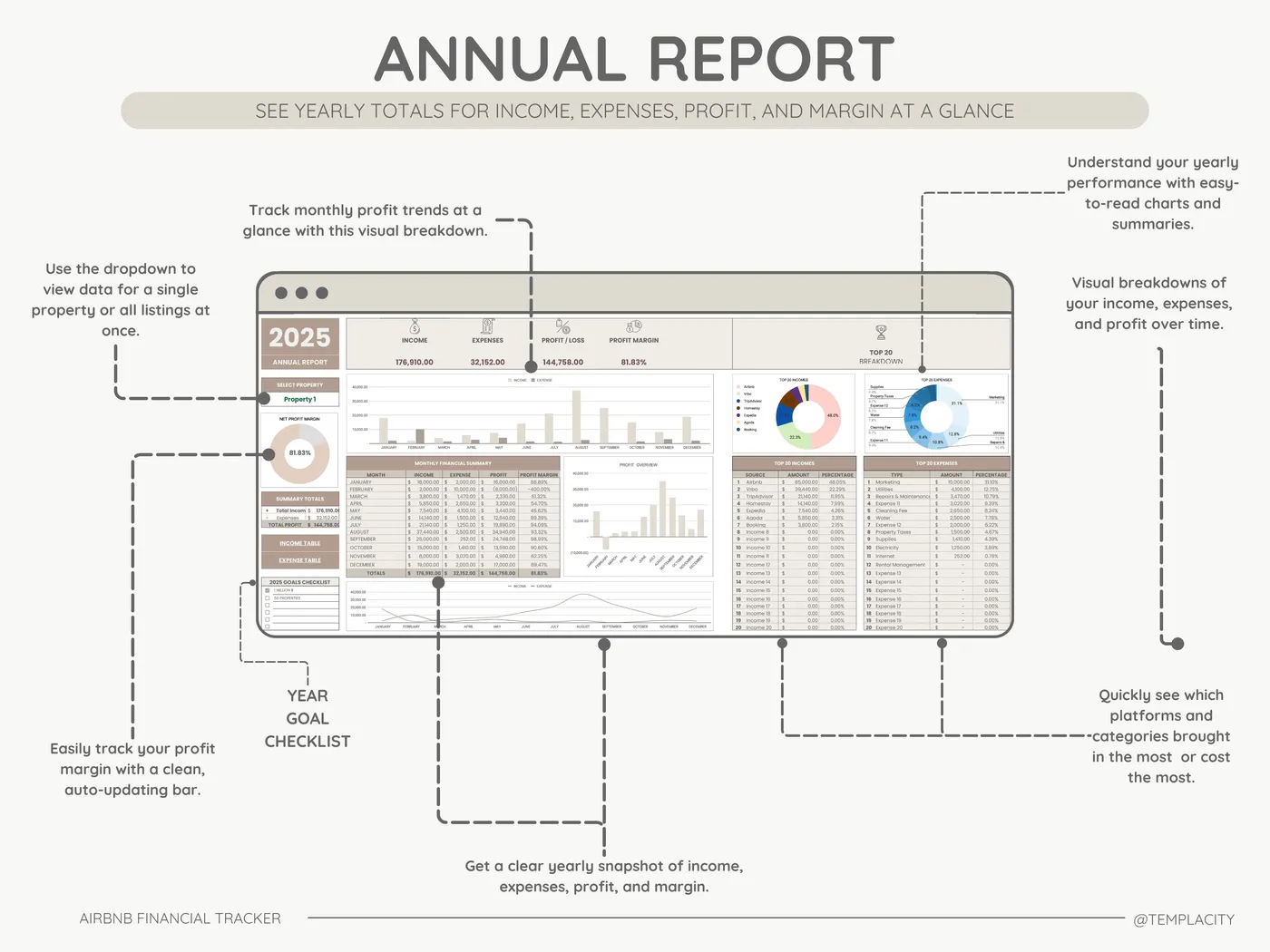

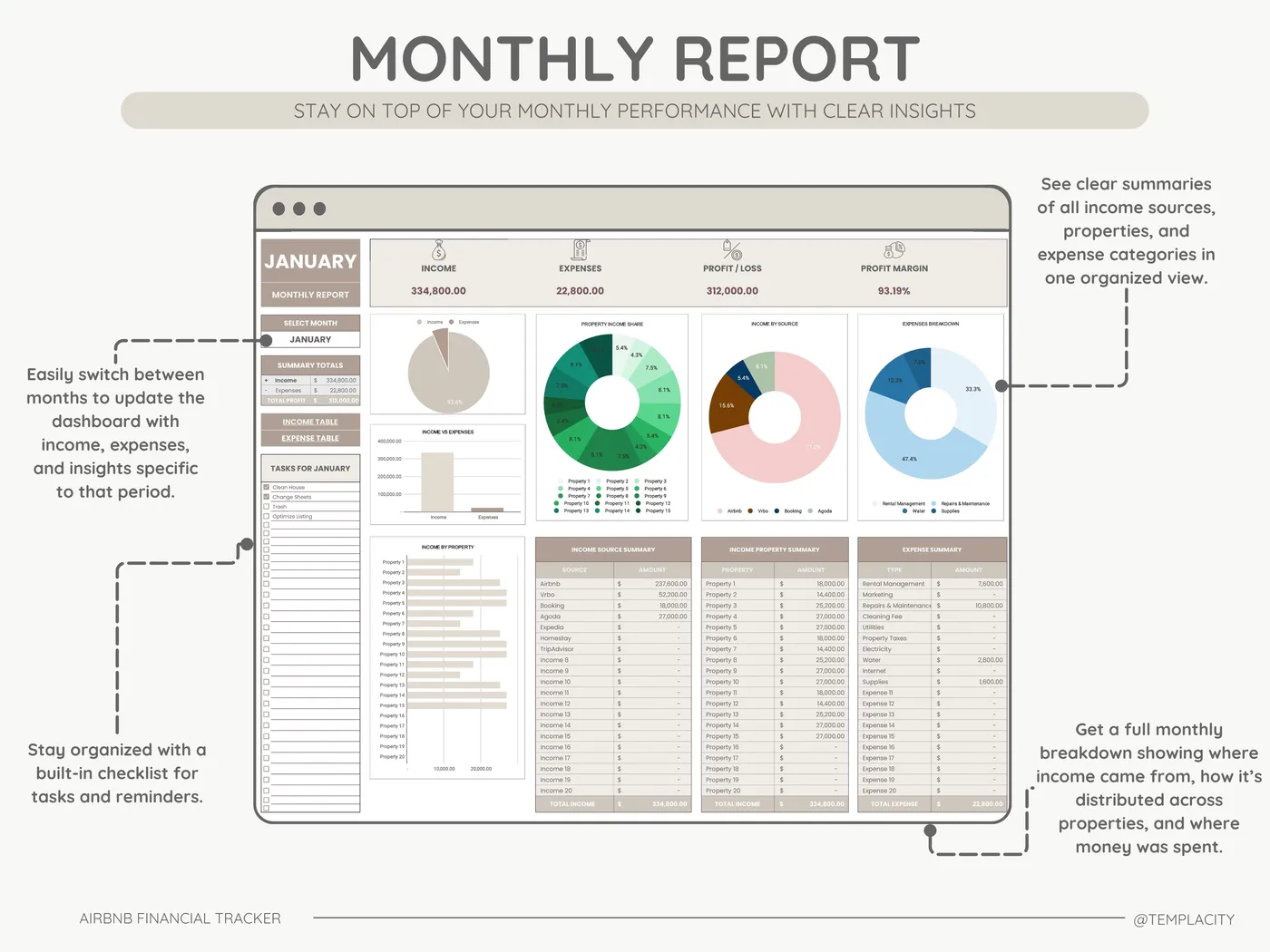

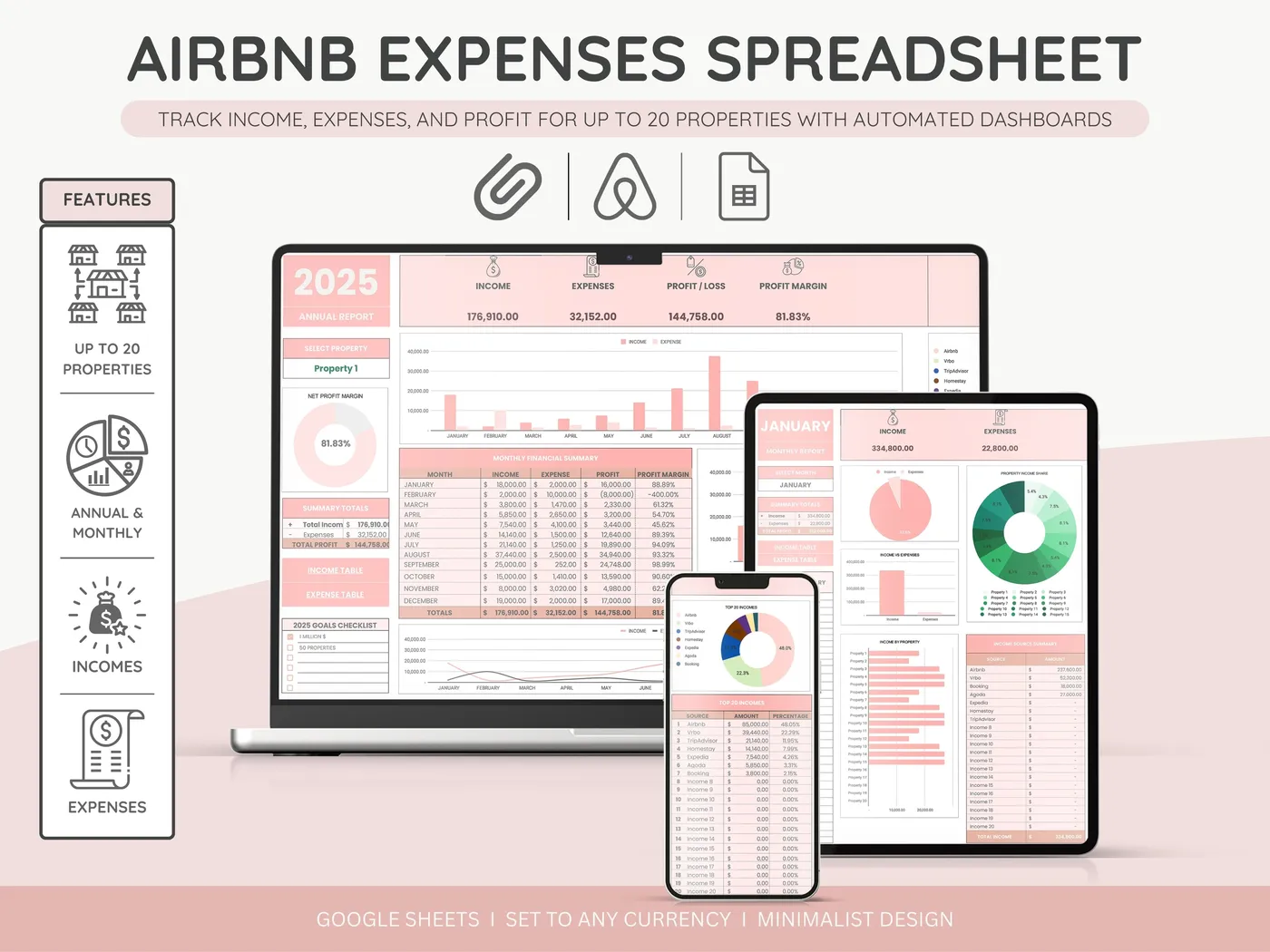

Don’t spend hours wrestling with complex formulas and broken charts. Download our pre-built Google Sheets template designed specifically for Airbnb hosts. It includes automated dashboards, dynamic drop-downs, and built-in Schedule E categorization.