reMarkable The Paper Tablet: Is It Still the King of Focus in 2026?

reMarkable The Paper Tablet: Is It Still the King of Focus in 2026? Brand Analysis reMarkable The Paper Tablet: Is It Still the King of

SHARE THIS POST

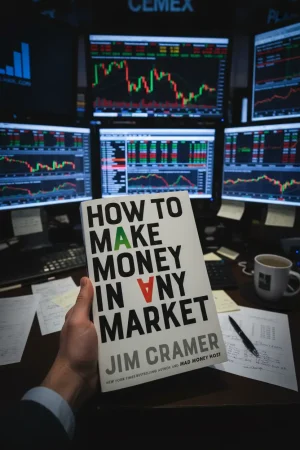

Author: James J. Cramer

Genres: Investing, Personal Finance, Business

Publication Date: September 30, 2025

Format: Hardcover

Star Rating: ★★★★☆ (4.2/5)

Estimated Reading Time: 2 minutes

How to Make Money in Any Market packages Jim Cramer’s decades of trading and media experience into a practical, rules-based framework. This how to make money in any market book review highlights his core message: you don’t have to guess the macro to succeed—if you manage risk, know what you own, and adapt position sizes to changing conditions.

Cramer organizes the book around three regimes—bull, bear, and range-bound—and shows how to tweak watchlists, entries, trims, and exits for each. He emphasizes homework (earnings calls, balance sheets, competitive moats), portfolio construction (pillars vs. spec positions), and the discipline of taking gains and cutting losers. Case studies from past cycles (dot-com, GFC, 2020s) illustrate how the same principles repeat with new tickers.

The prose is punchy and conversational, with clear chapter checklists and “don’t do this” callouts. Charts and simple tables keep the focus on process over prediction. Whether you agree with Cramer’s TV persona or not, the book reads like a tempered, classroom version: fewer theatrics, more playbook.

Strengths: actionable rules, regime-specific tactics, candid post-mortems of past mistakes.

Weaknesses: limited deep valuation models; advanced investors may want more factor/quant detail; some anecdotes assume U.S.-only access and tax context.

Early readers on Goodreads praise the checklists and risk-management focus. Amazon listeners appreciate the straight-to-the-point chapter summaries that translate well to busy retail investors.

Business outlets note the book’s practical tone compared with Cramer’s on-air style. Financial Times highlights the regime framework as a useful mindset; Morningstar underscores its position-sizing discipline; Forbes points out the thin coverage of taxes and portfolio turnover costs.

Best for retail investors seeking a rules-based approach, motivated beginners, and intermediate readers who want structure for volatile markets. Less ideal for readers seeking academic finance texts or purely passive indexing primers.

Jim Cramer is a longtime market commentator and former hedge-fund manager known for translating Wall Street to Main Street. His previous investing books and nightly show have shaped how many retail investors approach research and risk.

How to Make Money in Any Market won’t turn you into a macro oracle—and that’s the point. It’s a practical toolkit for surviving and compounding through shifting regimes by sticking to research, sizing, and sell discipline. Final Rating: ★★★★☆ (4.2/5)

For complementary perspectives, see Financial Times Books, Morningstar Articles, and Forbes Books.

Track your investing reads and notes with our Reading Tracker.

Subscribe for unbiased reviews and easy-to-use tools that help you choose and track your next read.

SHARE THIS POST

reMarkable The Paper Tablet: Is It Still the King of Focus in 2026? Brand Analysis reMarkable The Paper Tablet: Is It Still the King of

reMarkable Paper Pro vs Boox Go 10.3: The Color Giant or the Monochrome Blade? Head-to-Head Reviews reMarkable Paper Pro vs Boox Go 10.3: The Color

Free reMarkable Calendar Templates 2026: The Best Downloads & DIY Guides Free Resources Free reMarkable Calendar Templates 2026: The Best Downloads & DIY Guides The

Subscribe for unbiased reviews and easy-to-use tools that help you choose and track your next read.