Spain Airbnb Crackdown – What Hosts Must Know in 2025

The Spain Airbnb Crackdown has intensified in 2025, with the Spanish government ordering the removal of over 65,000 holiday rental listings that violate regulations. This

SHARE THIS POST

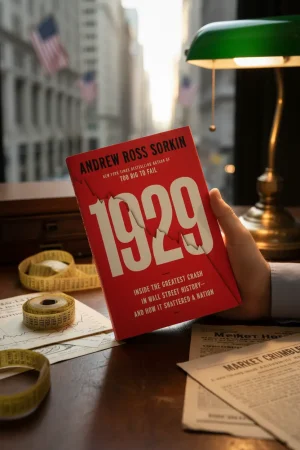

Author: Andrew Ross Sorkin

Genres: Financial History, Economics, Nonfiction

Publication Date: October 14, 2025

Publisher: Penguin Press

Pages: 480 (Hardcover)

ISBN: 9780593236216

Star Rating: ★★★★☆ (4.5/5)

Estimated Reading Time: 3 minutes

1929: Inside the Greatest Crash in Wall Street History—and How It Shattered a Nation is Andrew Ross Sorkin’s sweeping account of the financial collapse that triggered the Great Depression. This 1929 book review explores how Sorkin weaves archival research, personal stories, and market analysis into a compelling narrative that feels both historical and eerily contemporary.

The book reconstructs the days leading up to the October crash, spotlighting bankers, brokers, and everyday investors caught in the frenzy. It traces the speculative boom of the Roaring Twenties, the cascade of failures that followed Black Tuesday, and the profound social and political consequences that rippled across America. Sorkin draws parallels to modern crises, underlining the cyclical nature of financial excess and collapse.

Sorkin writes with narrative drive, balancing the pace of a thriller with the clarity of financial journalism. Vivid character portraits—of tycoons, regulators, and ruined families—anchor the story. He makes complex economic mechanisms readable without oversimplifying, echoing the style that made Too Big to Fail a bestseller.

Strengths: gripping storytelling, well-researched history, links to present-day crises.

Weaknesses: heavy on financial details at times, some readers may want more focus on ordinary citizens beyond market elites.

On Goodreads, early readers describe it as “engrossing and chilling,” praising its mix of narrative and analysis. Amazon reviewers highlight its accessibility for non-economists while appreciating its depth for seasoned readers of financial history.

The New York Times lauds it as “a definitive chronicle of America’s darkest financial hour.” Kirkus Reviews calls it “a sobering yet essential reminder of capitalism’s vulnerabilities.” Financial Times praises its scope and modern relevance, noting how it resonates with post-2008 anxieties.

Best suited for readers of financial history, economists, students of American politics, and anyone fascinated by the psychology of markets. Less appealing for readers seeking a purely narrative novel-style history with minimal economic analysis.

Andrew Ross Sorkin is a financial journalist, editor of DealBook at The New York Times, and author of Too Big to Fail. His expertise in explaining complex financial events makes him one of the most recognized voices in business reporting.

1929 is both history and warning: a masterclass in how financial systems unravel and how nations respond. Sorkin’s account is as gripping as it is sobering, making it a must-read for anyone who wants to understand markets and power. Final Rating: ★★★★☆ (4.5/5)

For more on financial crises and economics, see The New York Times Books, Kirkus Reviews, and Financial Times Books.

For other business and economics titles, check out The Art of Spending Money, The Preparation, and track your reading progress with our Reading Tracker.

Subscribe for unbiased reviews and easy-to-use tools that help you choose and track your next read.

SHARE THIS POST

The Spain Airbnb Crackdown has intensified in 2025, with the Spanish government ordering the removal of over 65,000 holiday rental listings that violate regulations. This

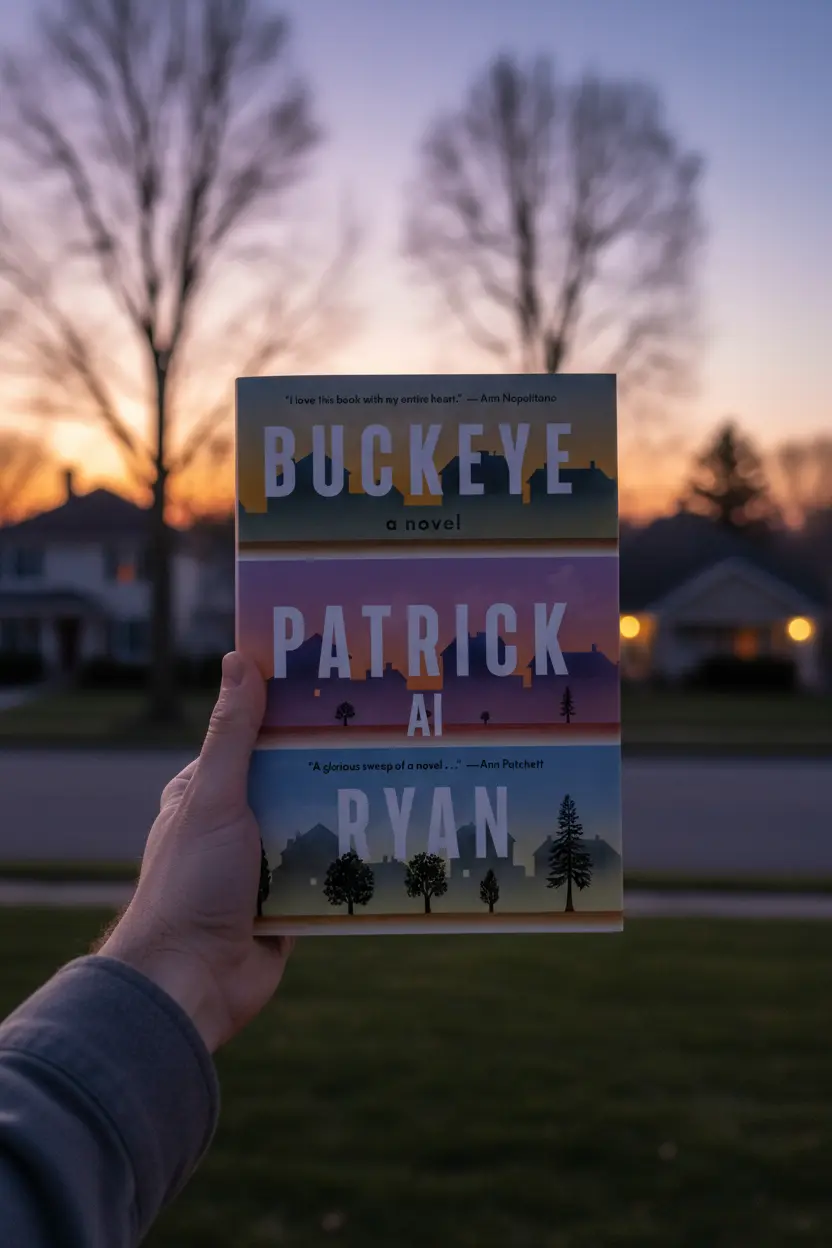

Buckeye a Novel Book Review This Buckeye a Novel Book Review looks at a newly trending work of fiction that has caught attention for both

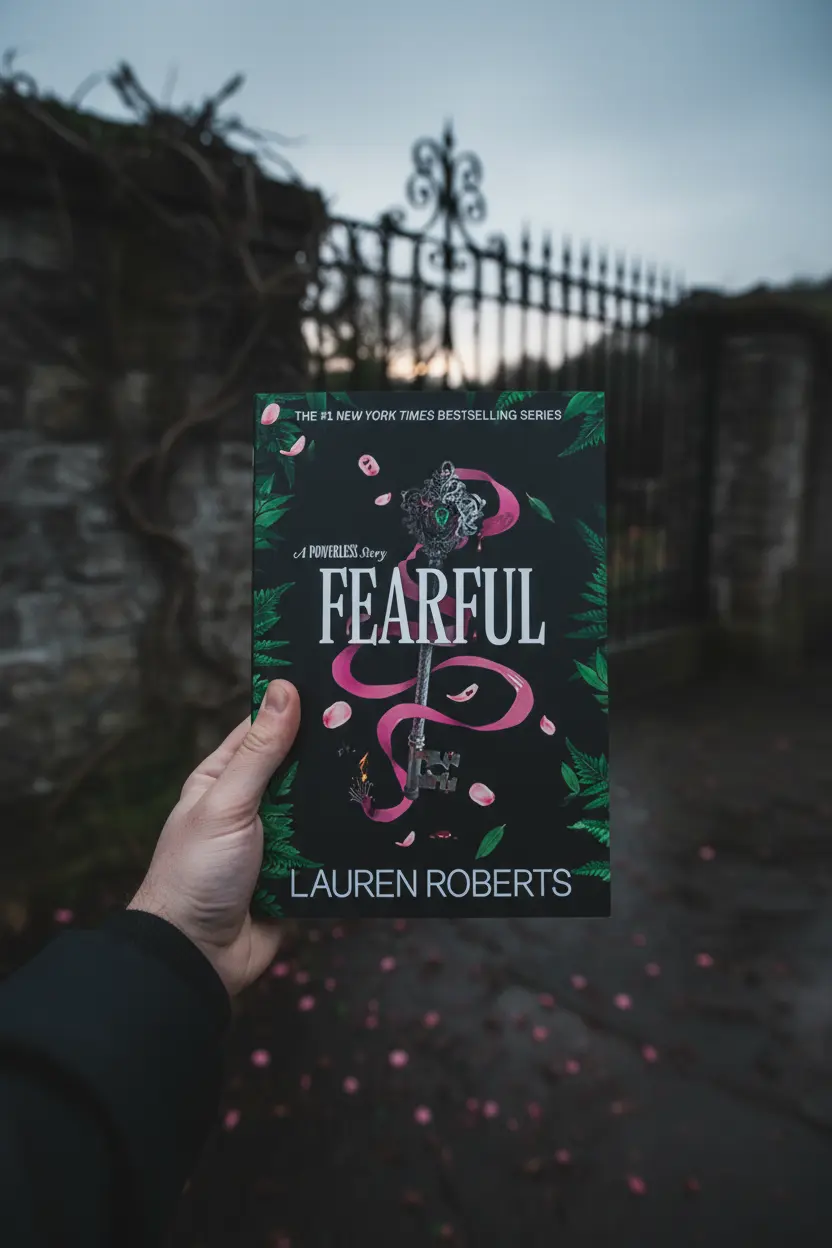

Fearful: A Powerless Story Book Review | Lauren Roberts Companion Novella Author: Lauren RobertsSeries: The Powerless Trilogy (#3.5)Genres: Fantasy, Young Adult, Romance, NovellaPublication Date: 2025

Subscribe for unbiased reviews and easy-to-use tools that help you choose and track your next read.