Ultimate Airbnb Tour de France 2025 Guide – Best Stays & Cities

The Airbnb Tour de France search trend is rising fast, and for good reason. The 2025 Tour de France will begin in Lille and end

SHARE THIS POST

Author: David Gardner

Genres: Personal Finance, Investing, Business

Publication Date: 2025 (Audible release)

Publisher: Harriman House

Format: Audible Audiobook (Unabridged)

Length: ~7 hrs listening time

Star Rating: ★★★★☆ (4.3/5)

Estimated Reading Time: 2 minutes

Rule Breaker Investing distills David Gardner’s decades of experience as co-founder of The Motley Fool into a practical playbook for spotting tomorrow’s stock market winners. This rule breaker investing book review examines how Gardner’s contrarian approach—favoring bold innovators over safe bets—has helped long-term investors find explosive returns.

The book lays out Gardner’s six “Rule Breaker” principles, from buying what you know and love to embracing volatility rather than fearing it. Through anecdotes about companies like Amazon, Tesla, and Netflix, Gardner illustrates how identifying visionary leaders and disruptive products early can generate outsized gains over years or decades.

Gardner’s tone is conversational and encouraging, making complex investing ideas digestible. His storytelling—mixing personal missteps with success stories—keeps the lessons grounded. As an audiobook, his narration adds warmth and conviction, reinforcing his belief in optimism and patience as core investing virtues.

Strengths: clear framework, inspiring real-world examples, long-term perspective.

Weaknesses: heavy focus on growth stocks may feel risky for conservative investors, fewer practical details on valuation metrics.

On Goodreads, readers highlight its motivational tone and accessibility for beginners. Amazon listeners praise Gardner’s narration and Fool-style optimism, though some note a bias toward success stories over failures.

Financial Times calls it “a manifesto for growth investing in the 21st century.” Morningstar describes it as “a refreshing antidote to fear-driven market strategies.” Forbes praises its clarity but cautions that “not all investors will have the temperament for Gardner’s volatility-friendly approach.”

This audiobook is ideal for retail investors, Motley Fool fans, and anyone curious about growth stock investing. Less suited for those looking for conservative dividend-focused strategies or detailed quantitative models.

David Gardner co-founded The Motley Fool with his brother Tom, building one of the most influential investing communities online. Known for spotting Amazon and Netflix early, Gardner has long advocated for optimism, patience, and disruptive innovation in investing.

Rule Breaker Investing is part memoir, part manifesto, and part guidebook for growth-minded investors. With humor, humility, and conviction, Gardner makes the case for optimism as the ultimate edge. Final Rating: ★★★★☆ (4.3/5)

For other takes on investing, check out Financial Times Books, Morningstar Articles, and Forbes Books.

Explore more titles on business and money: The Art of Spending Money, 1929, and track your financial reads with our Reading Tracker.

Subscribe for unbiased reviews and easy-to-use tools that help you choose and track your next read.

SHARE THIS POST

The Airbnb Tour de France search trend is rising fast, and for good reason. The 2025 Tour de France will begin in Lille and end

Killer Of The Flower Moon Book Review This Killer Of The Flower Moon Book Review looks at David Grann’s bestselling nonfiction book that exposes one

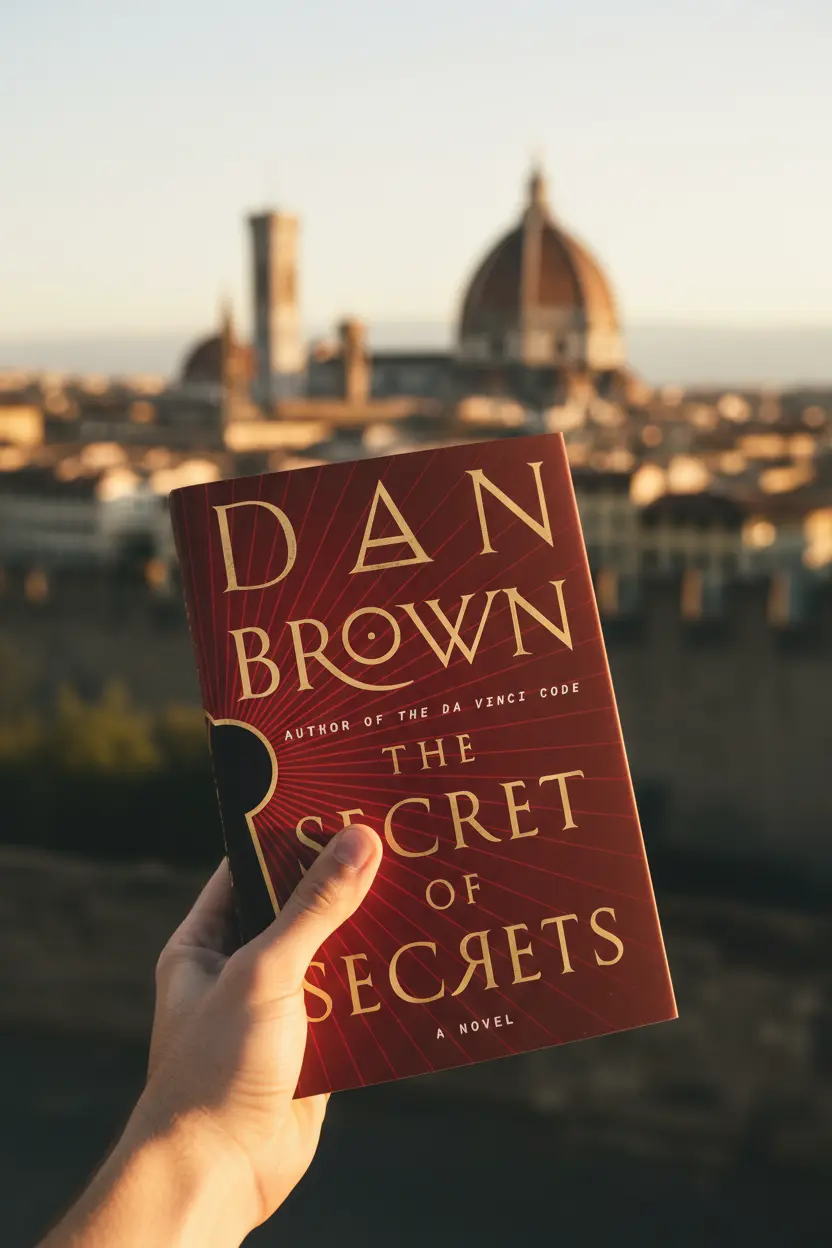

The Secret of Secrets Book Review | Dan Brown’s Robert Langdon Returns Author: Dan BrownGenres: Thriller, Mystery, Speculative FictionPublication Date: September 9, 2025Publisher: DoubledayPages: 688

Subscribe for unbiased reviews and easy-to-use tools that help you choose and track your next read.